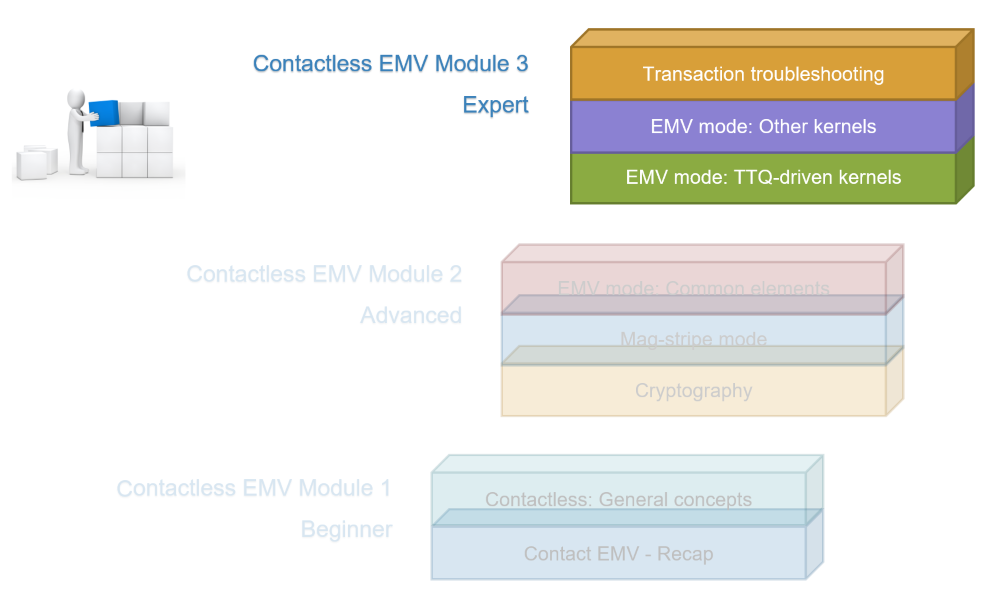

Welcome to the modular version of our course "Fast track to Contactless EMV expertise".

Contactless EMV Module 3: Expert

Finish your journey into the exciting world of Contactless EMV with the last module of our course 'Fast track to Contactless EMV expertise'.

Learn about the transaction flow for EMV mode, for kernels that are driven by a TTQ and those that are not. Take a deep dive into the APDUs and the new tags for contactless, and learn how to troubleshoot transactions.

Contactless EMV Module 3 is a 7-hour technical course that really focuses on EMV mode: APDUs, tags and troubleshooting. This module comes with practical exercises to help you assimilate the new concepts and to get practical experience on contactless EMV transaction analysis.

This last module is quite technical, and can be taken by anyone with basic IT knowledge who wants to start a journey towards contactless payment expertise. We strongly advise completing Modules 1 and 2 before taking this Module 3.

Upon completion of this module, an "Expert level" certificate is delivered to the student, which can be printed and shared on LinkedIn.

All the video lessons come with English closed captions/subtitles, which have been automatically translated into the following languages: Arabic, Chinese (Simplified), Dutch, Finnish, French, German, Greek, Hindi, Italian, Japanese, Korean, Persian, Polish, Portuguese, Russian, Spanish, Swedish, Tagalog, Tamil, Turkish, Ukrainian and Urdu.

Stay in touch with our newsletter

Do you want to get on the right track to becoming an expert?

Unique learning approach

The learning path is one of increasing complexity, with building blocks to construct the Contactless EMV knowledge, and practical exercises and quizzes to keep students engaged.

This is the last of 3 modules that will take you on a path towards Contactless EMV expertise.

The Contactless EMV Module 3 course starts with a deep dive into the transaction flow and the APDUs for TTQ-driven kernels (VISA, Discover, UnionPay). It looks at the new tags introduced specifically for contactless, which help transactions be processed faster. It explains how CVM selection is performed on those kernels, and how processing restrictions are enforced. It also briefly looks at how issuer scripts can be processed on those kernels.

The course then provides similar coverage of the other kernels (MasterCard, American Express and JCB). The transaction flow and the overall process is different, and the course highlights those differences and takes the student through how the APDUs are used with those kernels to complete transactions.

In the final chapter, the course provides a guided method to perform transaction analysis and troubleshooting, which includes a couple of diagrams that the student can download and print. This method is based on the instructor’s 10-year experience performing such analysis. The course also takes the student through 5 examples of contactless transactions being analysed with those troubleshooting diagrams.

Contactless EMV Module 3 curriculum

-

1

01. EMV mode: TTQ-driven kernels

- Course material

- 01-01. Kernels and Transaction flow

- 01-02. Selecting an application

- 01-02. Practical exercises on Selecting an application

- 01-03. Initiate Application Processing and Card decision

- 01-03. Practical exercises on Initiate Application Processing

- 01-04. APDU - GET PROCESSING OPTIONS

- 01-04. Practical exercises on GET PROCESSING OPTIONS command

- 01-05. Reading card data

- 01-05. Practical exercises on Reading card data

- 01-06. Processing Restrictions, ODA and CVM

- 01-06. Practical exercises on Processing Restrictions, ODA and CVM

- 01-07. Second presentment

- 01-07. Practical exercises on Second presentment

- Chapter 1 Quiz

-

2

02. EMV mode: Other kernels

- 02-01. Kernels and Transaction flow

- 02-02. Selecting an application

- 02-02. Practical exercises on Selecting an application

- 02-03. Getting the processing options

- 02-03. Practical exercises on Getting the processing options

- 02-04. Reading card data

- 02-04. Practical exercises on Reading card data

- 02-05. CVM Selection and Terminal Action Analysis

- 02-05. Practical exercises on CVM Selection and Terminal Action Analysis

- 02-06. Card decision

- 02-06. Practical exercises on Card decision

- Chapter 2 Quiz

-

3

03. Transaction troubleshooting

- 03-01. Contactless transaction troubleshooting

- 03-01. Diagrams for Contactless transaction troubleshooting

- 03-02. Examples of transaction analysis

- 03-02. Files analyzed in Examples of transaction analysis

- Course survey

Who is the course intended for?

I built the course with the following audience in mind: people who need strong Contactless EMV technical knowledge to be effective and efficient in their work. This includes roles in the following areas:

- Payment terminal EMV certification

- Payment terminal integration

- Payment terminal development or quality assurance

- Troubleshooting transaction failures for banks or acquirers

- Chip card issuance

- Chip card development or quality assurance

- Consulting in any of the areas above

I hope you’ll enjoy taking this course as much as I enjoyed building it.

FinTech courses from our partner

![[FinTech_stablecoin-101] [FinTech_stablecoin-101]](https://import.cdn.thinkific.com/65339/eetSA6RGQySeLvs7e4hZ_Thinkific%20-%20Intro%20to%20Stablecoin.png)

Intro to Stablecoin

[FinTech_stablecoin-101]

![[FinTech_alternative-lending-em] [FinTech_alternative-lending-em]](https://import.cdn.thinkific.com/65339/codzMtk9TCGmzziGABR7_Thinkific%20-%20Alternative%20Lending%20Emerging%20Markets.png)

Alternative Lending: Emerging Markets

[FinTech_alternative-lending-em]

![[FinTech_ai-in-fintech] [FinTech_ai-in-fintech]](https://import.cdn.thinkific.com/65339/kwdW6alQvqjt8ZnYmyR4_Thinkific%20-%20AI%20in%20FinTech.png)

AI in FinTech

[FinTech_ai-in-fintech]

![[FinTech_robo-advisors-101] [FinTech_robo-advisors-101]](https://import.cdn.thinkific.com/65339/MlKY6c9cTZCmgz6srOQp_Thinkific%20-%20Intro%20to%20Robo-Advisors.png)

Intro to Robo-Advisors

[FinTech_robo-advisors-101]

![[FinTech_insurtech-101] [FinTech_insurtech-101]](https://import.cdn.thinkific.com/65339/TMKDjgBaQKGJVcp2fTJC_Thinkific%20-%20Intro%20to%20InsurTech.png)

Intro to InsurTech

[FinTech_insurtech-101]

![[FinTech_crowdfunding-101] [FinTech_crowdfunding-101]](https://import.cdn.thinkific.com/65339/SYvNzmRRGiHg2cybWOri_Thinkific%20-%20Intro%20to%20Crowdfunding.png)

Intro to Crowdfunding

[FinTech_crowdfunding-101]

![[FinTech_intro-to-startups] [FinTech_intro-to-startups]](https://import.cdn.thinkific.com/65339/vlLvcZ6QVqXgkclF75DY_Thinkific%20-%20Intro%20to%20Startups.png)

Intro to Startups

[FinTech_intro-to-startups]

A building block towards innovation

EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere.

The EMV trademark is owned by EMVCo, LLC.